With Bschools coming out with their final lists, aspirants have a hard time during these months in deciding which Bschool to join or whether to continue with the job. ROI is one important factor to consider before taking this important decision.

Calculation of ROI, until now, as done by aspirants is based on a very simple formula: (Avg Placements) / (Fees of the college). But this formula misses out on lot of things. For starters, it does not consider the long term growth in your job but is based only on the first salary. Second, it does not account for the opportunity cost i.e. the amount of money you are expected to lose by not continuing with your job.

The formula I am writing here will be taught to you as soon as you attend the first lecture of Finance Management after joining the B-school but the irony is, that you need to know this to make that same decision – whether to join that B-school, some other or continue with the job.

The concept is simple and is known as Net Present Value (NPV). You predict the amount of cash flows for a long period, say 20 years, bring those cash flows to present value and add them. Probably some of you already know it, but let me elaborate for others. All you need is Microsoft Excel to do the calculations.

Make at least three columns: Year, Option 1 (say Job), Option 2 (say Bschool X). The year in which you expect to join the B-school, you start it as year ‘1’. You enter the amount of money you would have earned if you continued with the job in column ‘Job’ as positive, and the amount of fees you pay in the column ‘Bschool X’ corresponding to same year as negative. Continue this way for year ‘2’ as well. From third year the amount in Bschool column would also become positive and the value should be expected package. You might throw in higher salary in some year if you expect onsite any time soon. Also your salary each year should be growing by around 10-12% a year, and with little higher percentage every three-four years expecting some promotions or job switch.

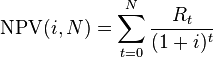

You can also do the calculations manually using the below formula:

Src: Wikipedia

The option which has the higher value of NPV has a higher ROI. From the indicative data, Bschool X has a higher value of ROI and the difference is around 18 lakhs over a period of 15 years.

However, in this method also we are not including intangible factors like position, job satisfaction, travel opportunities, etc. Hence, although, it is better method to calculate ROI this alone should not be used as a decision maker, but it sure can help you.